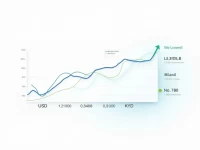

Guide to Converting USD to ZAR for Financial Gains

This article explores the exchange rate situation for converting US dollars (USD) to South African rand (ZAR) and the methods of transfer. It offers practical suggestions for reducing fees and conversion strategies to help users enhance the value of their funds during international transfers.